Economic Update from Adams Brown Wealth

Interest Rates, the Stock Market & Backup Withholding

Is the Fed Ready to Pause?

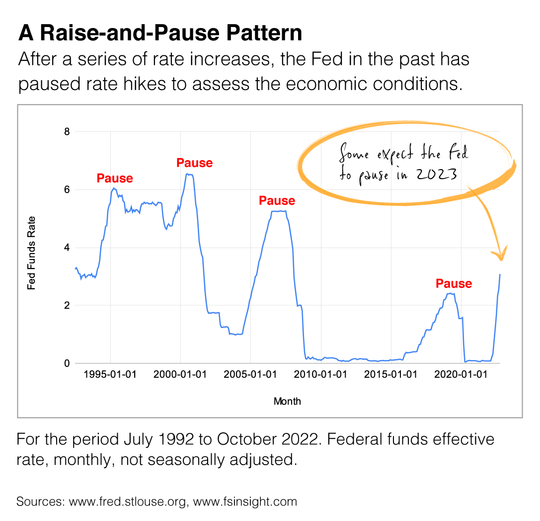

Over the years, the Fed has followed a similar pattern with interest rates. It raises interest rates, then pauses, so it can see how the economy is adjusting to the higher rates. The cart below shows the Fed’s pattern with short-term rates during the past 30 years.

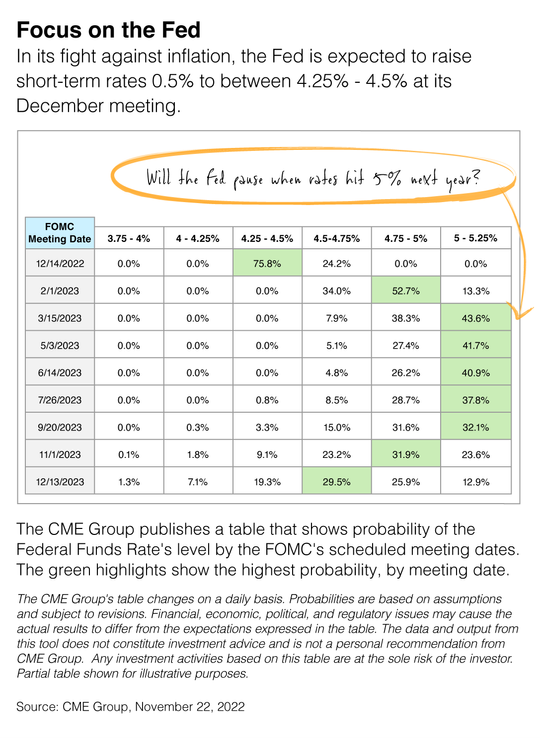

So, when will the Fed be ready to pause? In the table below, you can see that speculators are anticipating it may start as early as March 2023 when the Fed funds rate is between 5% and 5.25%.

The Federal Open Market Committee gave an update on its outlook for interest rates when it released the minutes from its November 2022 meeting.

“In addition, a substantial majority of participants judged that a slowing in the pace of (interest rate) increase(s) would likely soon be appropriate,” the Committee said. “A slower pace in these circumstances would better allow the Committee to assess progress toward its goals of maximum employment and price stability.”

It’s an encouraging update that leaves plenty of room for interpretation. But when investing, it’s best to focus on what you can control and understand that markets will fluctuate over time.

Learn About Backup Withholding

Backup withholding is when a taxpayer must withhold at the current rate of 24%, which is taken from any future payments, to ensure that the IRS receives the tax due on this income. This can happen for many reasons, including if you fail to provide a correct taxpayer identification number (TIN) or if you fail to report or underreport interest and dividend income. Many types of payments are subject to backup withholding, and you can view the complete list on the IRS’ website, but some include:

- Interest payments

- Dividends

- Rents, profits, or other gains

- Commissions, fees, or other payments for work you do as an independent contractor

- Royalty payments

- Gambling winnings

This information is not intended to be a substitute for specific individualized tax advice. We suggest that you discuss your specific tax issues with a qualified tax professional.

Source: IRS.gov, July 14, 2022

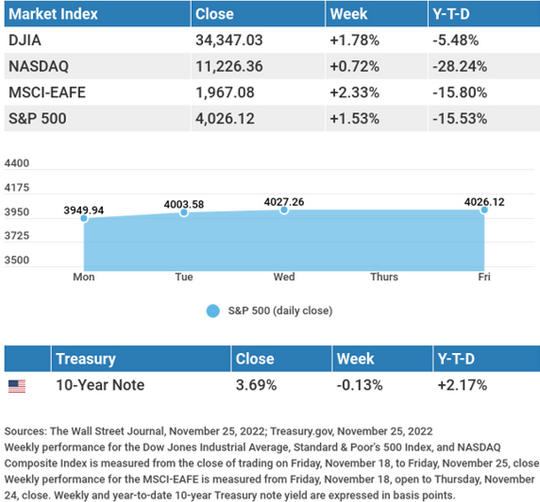

Stocks Rally

In light holiday-week trading, stocks rallied as investors grew more hopeful of a slowdown in a future rate hike. The release of the minutes from the early November meeting of the Federal Open Market Committee (FOMC) fed investors’ optimism. Fed officials suggested such easing may be coming soon. Investor sentiment was also lifted by unexpectedly strong retailer earnings, upside surprises in new economic data, and a better-than-expected consumer sentiment reading. Investors looked past the continuing Covid-related challenges that have stymied China’s economic recovery and its attendant implications for global growth.

Source: The Wall Street Journal, November 23, 2022

Market Insights

Food for Thought

“Challenging power structures from the inside, working the cracks within the system, however, requires learning to speak multiple languages of power convincingly.” – Patricia Hill Collins