2023 Retirement Plan Contribution Limitations

As a business owner, retirement plan contributions for 2023 should be top of mind. The IRS recently announced some of the largest cost-of-living adjustments in decades to the dollar limitations for defined contribution and defined benefit plans for the 2023 tax year. Most limits changed from 2022.

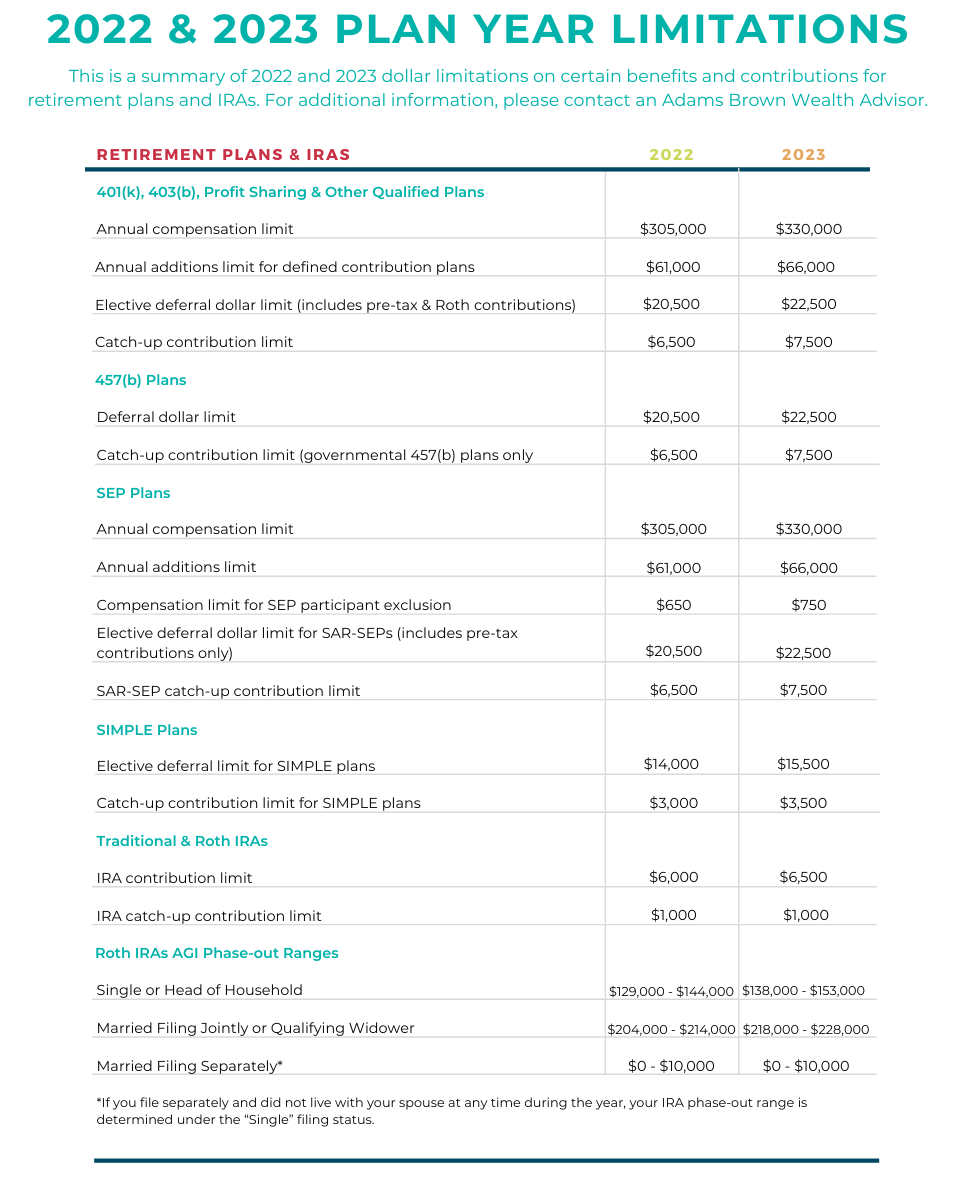

Employers can contribute more to retirement plans, allowing them to save more for retirement, and possibly obtain additional tax saving opportunities. The new 401(k), 403(b) and many 457(b)* deferral plan limits have increased from $20,500 in 2022 to $22,500 in 2023. Catch up contributions for those who are 50 years of age or older have increased from $6,500 to $7,500, meaning someone who turns 50 in the 2023 tax year may defer up to $30,000 either pre-tax or Roth, if the plan allows for it.

In addition to contribution increases, total employer and employee contributions to defined contribution plans are increasing from $61,000 to $66,000. Defined benefit plan annual contribution limit has been raised from $245,000 to $265,000.

Additional Contribution Limitations:

- The maximum allowable employer contribution is $66,000, or 25% of compensation limits, whichever is less.

- The maximum combined employer and employee contribution limit is also $66,000, or 100% of employee’s total compensation as allowed by the plan, whichever is less (plus $7,500 catch up for those 50 or older, bringing the total to $73,500).

- The SEP-IRA contribution limit is 25% of the employee’s compensation or $66,000 (age 50 catch up does not apply, because by law all SEP IRA contributions are employer).

- The SIMPLE-IRA contribution limit has been raised from $14,000 in 2022 to $15,500 for 2023, with the age 50 catch up limit increased from $3,000 to $3,500.

- The Solo 401(k) contribution limit is $66,000, or 100% of the employee’s compensation, whichever is less (plus the $7,500 catch up for those 50 or older).

- Traditional and Roth IRA** contribution limits have been raised from $6,000 to $6,500, while the age 50 catch up limit has remained at $1,000.

These new contribution limits provide an opportunity to save much more for retirement, and business owners should take full advantage of retirement plans to assist in their tax planning, enhanced creditor protection and to help recruit employees. Also, new legislation (SECURE Act 2.0) may also offer increased tax credits and incentives to start a new retirement plan or enhance an existing plan with features such as automatic enrollment and auto escalation features.

Keep in mind that the contribution limits are subject to change year to year, and the SECURE Act 2.0 may also impact or enhance these limits. As such, it is important to stay up to date on these limitations and consult your plan providers to ensure your plan documents accommodate these advantages.

Contact your Adams Brown wealth consultant to discuss how you can meet your retirement plan goals.

*Governmental 457(b) plan limits include elective deferrals (pre-tax and Roth) and employer contributions. Tax-Exempt 457(b) plan limits include elective deferrals (pre-tax only) and employer contributions.

**Roth IRA contribution limits are subject to phase-out limitations depending on income and tax filing status. Roth 401k contribution limits are not subject to these phase-outs.

Sources: IRS Tax Tip 2022-178 and IR-2022-188