Short-Term Shifts & Long-Term Opportunities

The Fed Cut Rates: What’s In It For you?

The Fed lowered short-term interest rates at its September 2025 meeting, but the question on most people’s minds is, “What’s in it for me?”

That’s a fair question, so here are some ideas to consider.

- First-wave changes: Any loan considered “variable rate” can be expected to adjust relatively quickly, as with a home equity line of credit (HELOC). However, don’t get too excited. The change is likely to be relatively small.

- Second-wave changes: If you’re buying a home, the Fed’s change may affect your mortgage rate. If you’re refinancing, you may also see rates change. If you’re shopping for a new car, you may see new advertised rates on car loans.

- Long-term changes: Credit card companies might adjust their interest rates, but it may take several payment cycles before you see any movement. Remember, if you have a fixed-rate mortgage, the interest rate will not change unless you refinance or sell your home.

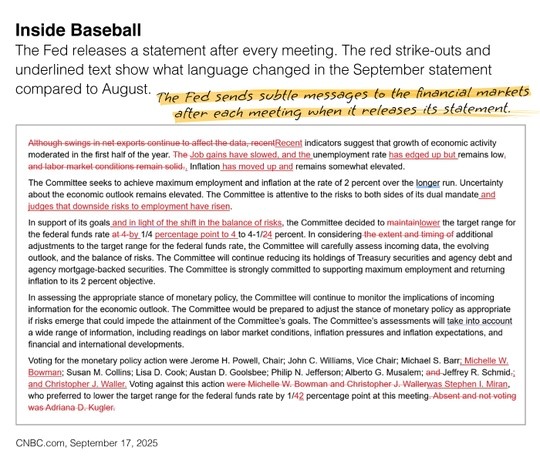

The Fed’s September rate cut signals a shift in monetary policy by the central bank. It was the first time the Fed lowered the benchmark rate in months. Fed Chair Jerome Powell indicated more adjustments were likely this year and into 2026 to address economic concerns, including a sluggish labor market.

So, while you may see a few benefits in the short term, more opportunities may present themselves in the longer term.

Market Insights

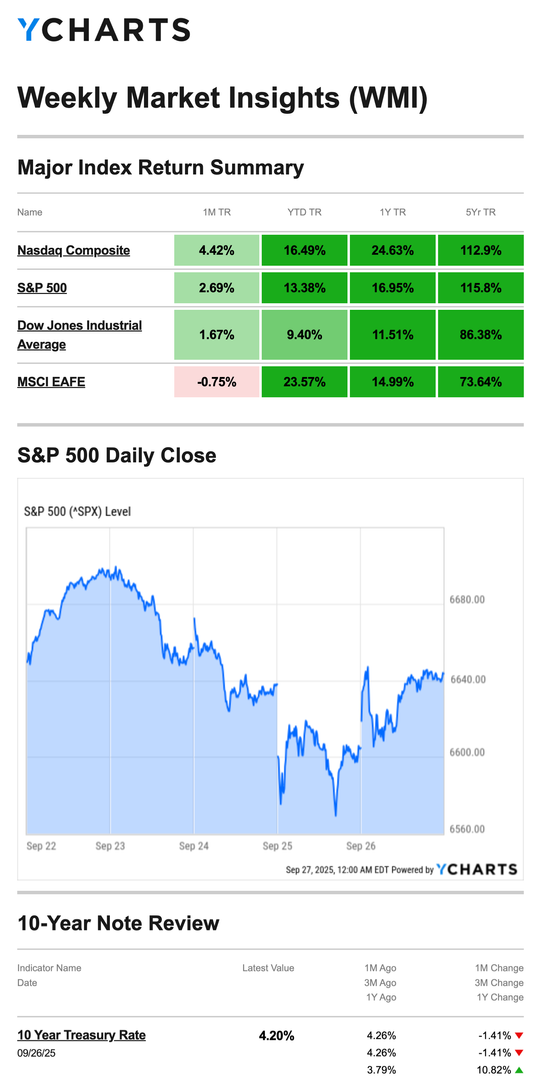

Stocks fell last week, buffeted by concerns about stock price valuations and a possible government shutdown.

The Standard & Poor’s 500 Index declined 0.31 percent, while the Nasdaq Composite Index lost 0.65 percent. The Dow Jones Industrial Average slipped 0.15 percent. The MSCI EAFE Index, which tracks developed overseas stock markets, fell 0.34 percent.

Stocks Under Pressure

The S&P 500 and the small-cap index Russell 2000 hit all-time intraday highs on Tuesday, September 23 before trending lower. The decline turned into a three-day retreat for stocks.

Adding to the selling pressure was Federal Reserve Chair Powell, who made cautious comments on stock price valuations on Tuesday. Investors were also watching a possible government shutdown as Congressional budget deliberations appeared to stall.

It was the first time in six months that all three averages (Dow, S&P 500, and Nasdaq) declined over three consecutive sessions.

Stocks rebounded Friday after the Personal Consumption & Expenditures (PCE) Index—the Fed’s preferred inflation measure—was in line with expectations. The news appeared to reassure investors that the Fed would move ahead with its “penciled-in” rate adjustments for the remainder of this year.

A flurry of updated economic data hit last week. Here are the key takeaways:

Overall, the indicators suggested a strong economy. The final estimate of Q2 gross domestic product was 3.8 percent, stronger than previous reports. Durable goods orders rebounded in August, driven by a surge in aircraft orders. And weekly jobless claims fell.

The fact that the PCE was in line with estimates—core inflation of 2.9 percent year over year—was welcomed news for investors. The report seemed to support Fed Chair Powell’s position, who on Tuesday suggested that weakness in the labor market outweighed concerns about stubborn inflation.

Adjusted for Inflation

Let’s examine how “adjusted for inflation” has affected a few of tax rules and their impact on Social Security.

- How about the $3,000 investment loss that can be used to offset ordinary income? That rule was set in 1978. If adjusted for inflation, about $15,000 in investment losses could be used to offset ordinary income today.

- What about the home capital gains exclusion of $500,000 for married taxpayers and $250,000 for single taxpayers? That rule was set in 1997. If adjusted for inflation, today’s numbers would be roughly $1,000,000 and $500,000, respectively.

- What about Social Security? Social Security benefits have been adjusted for inflation since 1975, when the average monthly payout for retirees was $207. In 2025, the average benefit was $1,976. Adjusted for inflation is a powerful phrase!

- How about the Alternative Minimum Tax? The earliest version of AMT was first passed by Congress in 1969 after then Treasury Secretary Joseph Barr was mad that 155 high-income taxpayers didn’t pay any federal income taxes. It was not indexed for inflation. In 2017, more than 5.2 million taxpayers were paying the “Alt-Min,” up from 155 to 5,200,000, all because it wasn’t adjusted.

So the next time you hear, or don’t hear, that phrase, pay attention. Whether something is or isn’t may have a big impact on you.

October is National Financial Planning Month

October marks National Financial Planning Month, making it an ideal time for a financial health check-up. Just as you schedule annual medical exams, this month offers a natural opportunity to assess your financial situation, acknowledge your successes, and make strategic adjustments before year-end.

Why work with a financial professional?

People at every life stage, whether working, approaching retirement or already retired, seek financial guidance. While their specific concerns vary, from maximizing workplace benefits to managing debt or planning for long-term care, they share a common goal: greater confidence in their financial decisions.

Here are a few common topics that often come up this time of year:

- Year-end strategies: Are there charitable contributions or investment adjustments to consider before December 31?

- Account contributions: Have you reviewed your retirement or health savings accounts?

- Goal check-in: Small steps made now can support longer-term goals.

- Looking ahead: It’s never too early to consider what you’d like to prioritize in the upcoming year.

Everyone’s financial situation is unique, but you don’t have to figure it all out alone.

If any of this has been on your mind lately, contact an Adams Brown Wealth Consultant today.

Source(s):

CNBC.com

YCharts.com, September 27, 2025. TR = total return for the index, which includes any dividends as well as any other cash distributions during the period. Treasury note yield is expressed in basis points.

Congress.gov, 2025. “An Analysis of the Tax Treatment of Capital Losses.”

Congress.gov, 2025. “The Exclusion of Capital Gains for Owner Occupied Housing.”

Nasdaq.com, 2025. “This Was the Average Social Security Benefit in 1975, and Here’s What It Is Now.”

TaxPolicyCenter.org, 2025. “What is the AMT?”

This material was developed and produced by FMG Suite to provide information on a topic that may be of interest. FMG Suite is not affiliated with the named broker-dealer, state- or SEC-registered investment advisory firm.

Forecasts are based on assumptions and are subject to revisions over time. Financial, economic, political, and regulatory issues may cause the actual results to differ from the expectations expressed in the forecast.