Frustrated Following The Fed?

Stocks Bounce Back – Twice

Let’s start with the conclusion: Stick with your investment strategy, and don’t let outside influences like the Fed get in your way.

Following the Fed these days is like watching an endless point in a tennis match. The back-and-forth is causing anxiety, anticipation, more anxiety and confusion.

At its March meeting, Fed officials said they penciled in three quarter-point cuts in short-term rates by the end of 2024. But wait. Not so fast.

In the following weeks, Atlanta Fed President Raphael Bostic suggested one cut. San Francisco Fed President Mary Daly noted no guarantees and Cleveland’s President Loretta Mester said rate cuts may come later this year. Minneapolis President Neel Kashkari said that no cuts may be on the table, followed by Fed Governor Michelle Bowman, who said it’s possible rates may have to move higher to control inflation.

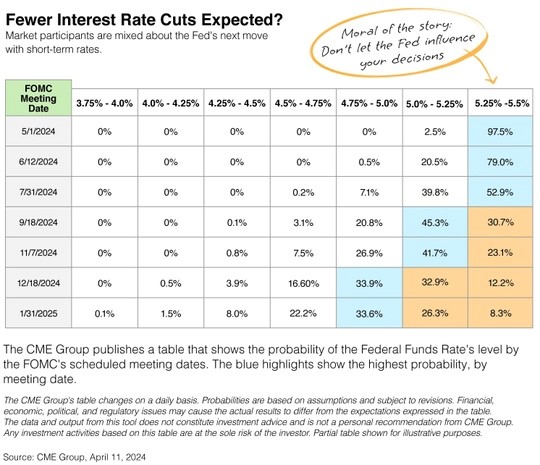

Confused? You’re not alone. So are the financial markets. As you can see in the table below, market speculators now anticipate only one, maybe two, cuts this year. But as the percentages show, there’s not much conviction in any outlook.

The April Consumer Price Index report only added to the confusion. When consumer prices came in a bit hotter-than-expected, that added to the uncertainty about what’s next with the Fed. So, try to stay focused, tune out the noise and don’t get pulled into the guessing game “What the Fed is Going to do Next?”

Market Insights

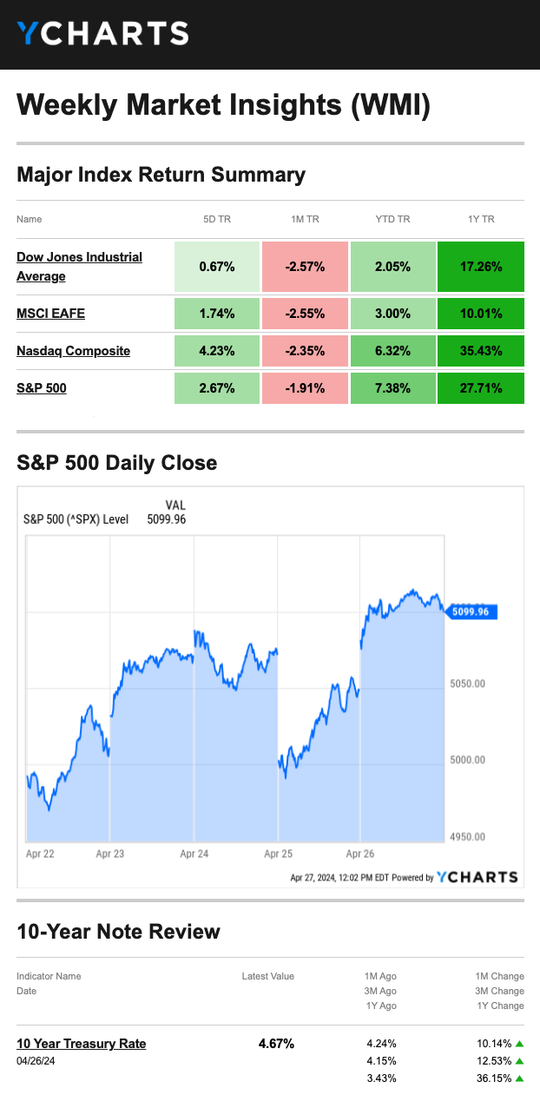

Stocks staged a choppy comeback last week as investors cheered positive earnings, led by mega-cap tech stocks. The rally came to pass despite fresh data showing a slowing economy and increasing inflationary pressures.

Last week opened with a rebound rally as investors breathed a sigh of relief that Middle East tensions had eased. The market rally extended into Tuesday, with investors cheering positive corporate earnings reports. By Tuesday’s market close, the S&P 500 had gained 2% for the week.

But investor enthusiasm didn’t last, as midweek saw profit taking in all three averages. Rising bond yields threw a wet blanket on market momentum; at one point, the yield on the 10-year Treasury note rose more than 40 basis points from its low earlier in the week.

On Thursday, markets slipped on two fresh pieces of economic data: a Gross Domestic Product (GDP) slowdown and higher consumer prices. But by midday, selling pressure slowed. Stocks pushed higher on Friday behind upbeat Q1 reports from two mega-cap tech stocks, helping the S&P 500 and the Nasdaq post their best week since November.

Source: YCharts.com, April 27, 2024

It’s Time for Q1 Company Reports

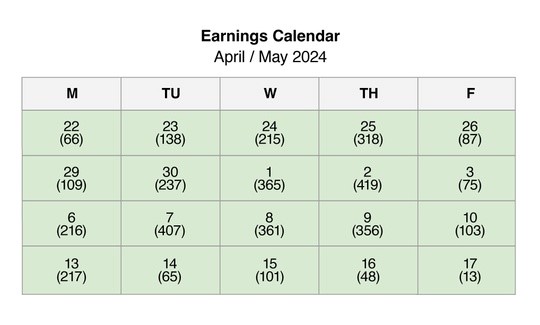

Over the next few weeks, the vast majority of publicly traded companies will update shareholders on business conditions in Q1. It’s called “earnings season,” and it happens four times a year.

So buckle up because it’s relatively likely that you’ll read about one company’s success, followed by news of another’s missteps, more than once in the coming weeks. In the table below, you can see the next month of company reports. On a busy day, more than 400 companies will check in with their numbers. On slow days, typically Mondays and Fridays, you can expect to hear from fewer.

Updates on inflation and artificial intelligence have been the most popular topics. In Q3 2023, “AI” was said nearly 150 times. In Q4 of that same year, the term “inflation” was mentioned at least once during the quarterly calls of over 250 S&P 500 companies. Either could be popular again this quarter.

Updates on inflation and artificial intelligence have been the most popular topics. In Q3 2023, “AI” was said nearly 150 times. In Q4 of that same year, the term “inflation” was mentioned at least once during the quarterly calls of over 250 S&P 500 companies. Either could be popular again this quarter.

So far this earnings season, several large banks in the S&P 500 have posted results and their focus has been on the Fed and interest rates. Of course, you would expect banks to talk about interest rates, whereas it may not be as important to a tech company, for example.

It’s best to prepare for some market volatility as Wall Street starts to collect info about the 2024 business climate. If you want to know when a particular company is reporting, please contact an Adams Brown wealth consultant. Most have already set the date they are prepared to check in with results.

Source: MarketWatch.com, April 19, 2024. Earnings Calendar.

The opinions contained herein are that of the authors and not necessarily that of Private Client Services LLC and should not be construed as tax or legal advice nor should there be any guarantees assumed from the information presented.