How Wall Street & Tax Changes Shape the Year Ahead

When you see the word “forecast,” it should be closely followed by, “Forecasts are based on assumptions and are subject to revisions over time. Financial, economic, political and regulatory issues may cause the actual results to differ from the forecast.”

That was so true in 2025.

After April 2, 2025, when Liberation Day tariffs were rolled out, many market gurus lowered their full-year forecast for the S&P 500—only to update their outlook again a few months later as stock prices roared higher.

So a lesson learned—forecasts can be moving targets on Wall Street.

The table below shows what the Street’s best and brightest are looking for in 2026. If you toss out the highest and lowest, you can see that the others settle into a pretty tight range for the year.

Stocks trended lower last week amid signs of year-end profit-taking and some sour investor sentiment over the Fed meeting minutes.

The Standard & Poor’s 500 Index fell 1.03 percent, while the Nasdaq Composite Index lost 1.52 percent. The Dow Jones Industrial Average slid 0.67 percent. The MSCI EAFE Index, which tracks developed overseas stock markets, ticked up 0.31 percent.

Santa Rally, Interrupted

Stocks opened lower to start the shortened holiday week with tech shares under pressure. Markets then moved sideways, but came under pressure after minutes from the December Federal Reserve meeting were released. Investors digested the details, which showed members remained divided.

Stocks recovered some ground on the first trading day of 2026. The tech sector was mixed, with AI chip stocks pushing higher, while other areas of technology, especially software companies, declined. Overall, the S&P 500 and Dow Industrials logged gains to kick off the new year, which helped pair losses from earlier in the week.

It remains to be seen whether the “Santa Claus rally”, which ended Monday, Jan. 5, will materialize. The Santa period is the last five trading days of December through the first two trading days of the new year.

2026 Federal Tax Update

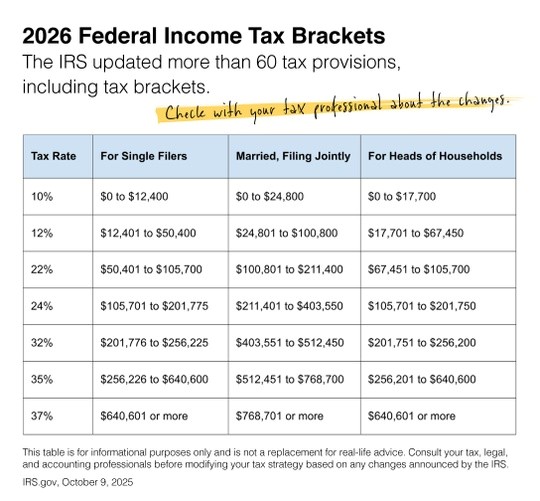

When the One Big Beautiful Bill (OBBB) Act was passed on July 4, the legislation left several unanswered questions that the IRS is now addressing. The IRS undergoes this process every year, but this time around, the OBBB has added to the uncertainty. The Internal Revenue Service reviews more than 60 tax provisions for inflation to prevent what is known as “bracket creep.”

The IRS announced new federal income tax brackets and standard deductions for 2026 in early October. The agency adjusted several numbers, which apply to tax year 2026 for returns filed in 2027.

New Retirement Contribution Limits for 2026

The Internal Revenue Service recently released new limits for 2026. Although these adjustments won’t bring any major changes, there are some minor elements to note.

- Individual Retirement Accounts (IRAs)

IRA contribution limits are up $500 in 2026 to $7,500. Catch-up contributions for those over age 50 are up $100 to $1,100, bringing the total limit to $8,600. - Roth IRAs

The income phase-out range for Roth IRA contributions increases to $153,000-$168,000 for single filers and heads of household. For married couples filing jointly, the phase-out will be $242,000 to $252,000. Married individuals filing separately see their phase-out range remain at $0-10,000. - Workplace Retirement Accounts

Those with 401(k), 403(b), 457 plans, and similar accounts will see a $1,000 increase for 2026, the limit rising to $24,500. Those aged 50 and older will now have the ability to contribute an extra $8,000, bringing their total limit to $32,500. Those aged 60, 61, 62, and 63 may enjoy a higher catch-up contribution of $11,250, raising their total contribution limit to $35,750. - SIMPLE Accounts

A $500 increase in limits for 2026 gives individuals contributing to this incentive match plan a $17,000 stoplight. Pursuant to the Secure Act 2.0, certain applicable plans have an increased limit of $18,100. - Other Changes

In addition to contribution limit changes, the IRS also announced several other amendments for 2026, including an increase to the annual exclusion for gifts to $19,000 per person and an increase to the estate tax exclusion threshold.

Contact us if you have any questions about the IRS updates or any other tax law changes.

Source(s):

TheStreet.com, “Bank of America unveils surprise 2026 stock-market forecast,” Dec. 4, 2025.

WSJ.com, Jan. 2, 2026

Investing.com, Jan. 2, 2026

YCharts.com, Jan. 3, 2026 – Weekly performance is measured from Friday, Dec. 26, to Friday, Jan. 2. TR = total return for the index, which includes any dividends as well as any other cash distributions during the period. Treasury note yield is expressed in basis points.