Wasn’t There Supposed to be a Recession?

Why the Drop in Inflation was Such a Big Deal

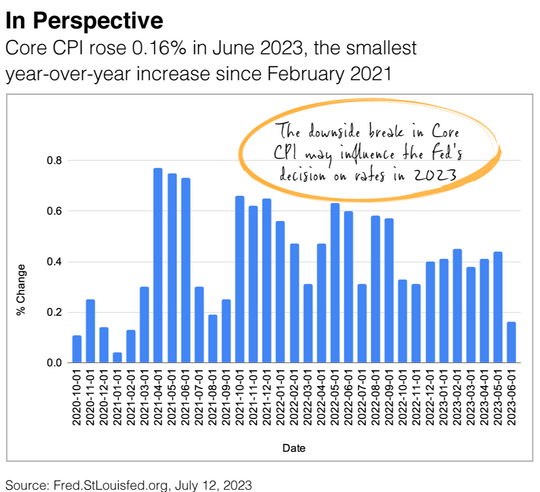

Sometimes, a picture is worth 1,000 words. So here is an image of the June Consumer Price Index (CPI) report to help put inflation in better perspective:

Core CPI, which excludes volatile food and energy prices, rose just 0.16 percent for the month, the lowest reading in more than two years and a significant downside break. There are a number of reasons why it was such a big deal, including:

- It was a downside surprise compared to the consensus estimate of 0.30%.

- On a YoY basis, 0.16% translates to 1.92% inflation on an annual basis.

- It may give the Fed some flexibility with interest rates in the second half of 2023.

- June’s Producer Price Index, released the day after the June CPI report, rose less than expected, building on the optimism about inflation.

The first quarter gross domestic product expanded at a 2% rate, and the job market appears in good shape. Meanwhile, the stock market, considered a lead indicator, rallied in the first half, catching some by surprise.

Those in the “just a matter of time before a recession” camp point to the yield curve. It remains inverted, with the interest rate on 2-year Treasury notes higher than on 10-year Treasury notes. Historically, an inverted yield curve has signaled a recession.

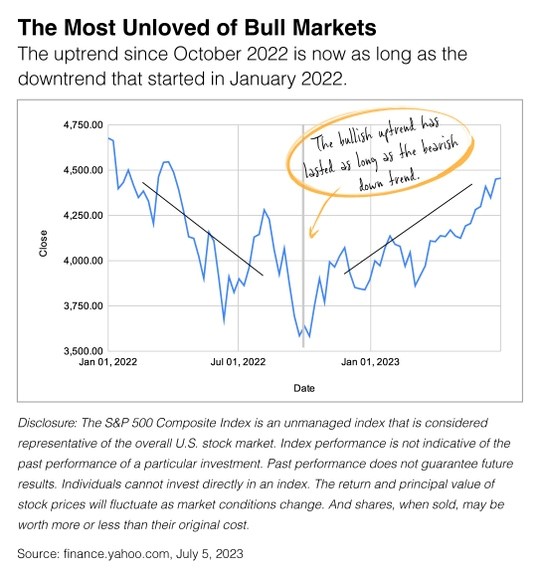

The accompanying chart shows that the current market rally has lasted roughly nine months, which is about the length of the market’s downtrend in 2022. While the Standard & Poor’s 500 remains well below the high, the downtrend and the uptrend are starting to look similar.

What’s next for the economy and the stock market? We don’t know the future, but what’s next for us is to remain focused on investment strategy, which reflects your goals, time horizon and risk tolerance.

Source: CNBC.com, July 13, 2023. “S&P 500 rises for a fourth day on more encouraging inflation data.”

Market Insights

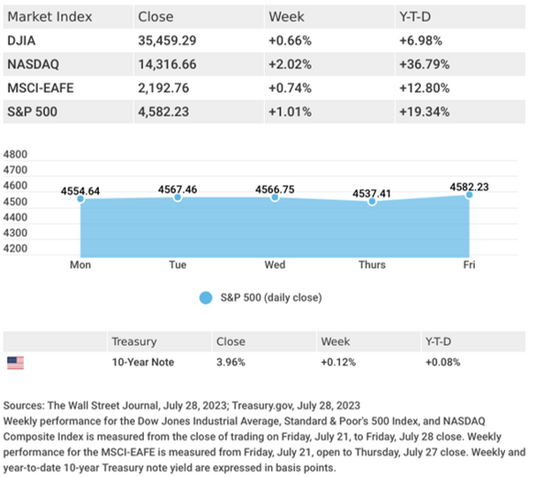

A Friday surge pushed stocks solidly into positive territory last week, ignited by cooling in an inflation gauge closely tracked by the Federal Reserve.

The Dow Jones Industrial Average advanced 0.66%, while the Standard & Poor’s 500 climbed 1.01%. The Nasdaq Composite index rose 2.02% for the week. The MSCI EAFE index, which tracks developed overseas stock markets, gained 0.74%.

Stocks Pop

Stocks were flat for much of last week amid a batch of new earnings, a 0.25% interest rate hike, and strong economic data. After beginning with gains, stocks lost momentum following the Fed’s expected rate-hike announcement on Wednesday. A bounce on Thursday sparked by a positive mega-cap tech company earnings reversed after bond yields increased.

Stocks recovered strongly Friday on the release of the personal consumption expenditures price index, which fell to its lowest level in two years. Much of the market action was related to earnings results. With 44% of S&P 500 companies reporting, 78% have exceeded Wall Street forecasts.