What’s Next for Interest Rates, Inflation?

U.S./China Tariff Truce Tames Markets

The Fed’s May meeting was pretty much a humdrum event. Even Fed Chair Powell’s post-meeting press conference was uneventful.

“We are always going to do the same thing,” he said. “We are going to use our tools to foster maximum employment and price stability for the benefit of the American people. We are always going to consider only the economic data, the outlook, the balance of risks and that’s it. That’s all we are going to consider.”

The cost of shelter is not included in the Harmonized Index of Consumer Prices (HICP), Europe’s version of the Consumer Price Index (CPI). Without housing costs, the U.S. core consumer price index in April would have been 1.8 percent on a year-over-year basis.

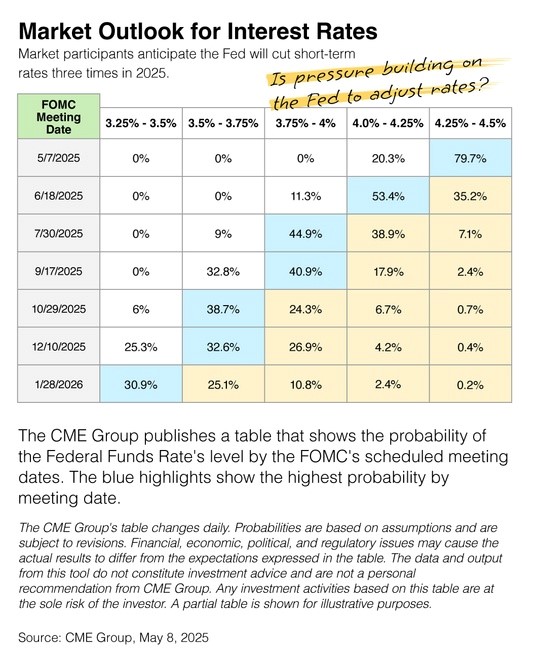

But what lies ahead for short-term interest rates? As the table shows, traders see the Fed adjusting rates three times in 2025, with the first move coming as early as July.

The Fed is engaging in a balancing act between managing inflation and supporting economic growth. As we move through the next few months, we may see which side tips the balance.

The Fed is engaging in a balancing act between managing inflation and supporting economic growth. As we move through the next few months, we may see which side tips the balance.

Sources: CMEGroup.com, May 8, 2025

Market Insights

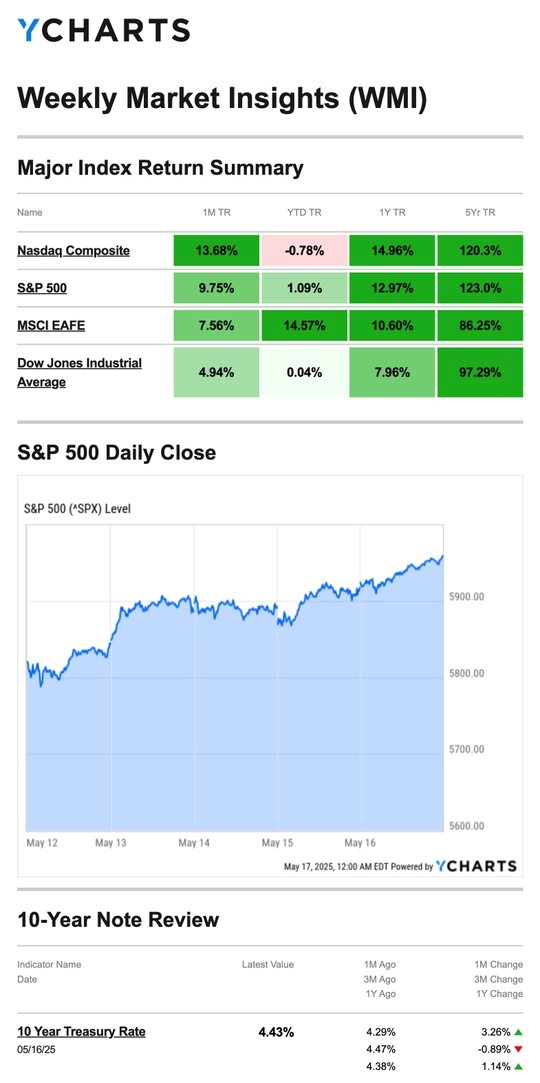

Stocks roared higher last week, powered by upbeat trade news and tame inflation reports.

The Standard & Poor’s 500 Index rose 5.27 percent, while the Nasdaq Composite Index spiked 7.15 percent. The Dow Jones Industrial Average added 3.41 percent. The MSCI EAFE Index, which tracks developed overseas stock markets, increased 0.80 percent.

S&P, Dow Erase YTD Losses

Stocks pushed higher on Monday as investors cheered weekend news that the U.S. and China temporarily agreed to back off steep reciprocal tariffs.

Then, a mild inflation report for April—the slowest annualized Consumer Price Index (CPI) reading in four years—boosted markets on Tuesday. Tech stocks powered the rally as the S&P 500 closed trading in the green for the year.

Markets closed the week with modest gains, largely looking past weak consumer sentiment data released on Friday.

Friday was the Dow’s turn to erase year-to-date losses and get back in the green while the Nasdaq and S&P notched a five-day winning streak.

Source: YCharts.com, May 17, 2025. Weekly performance is measured from Monday, May 12 to Friday, May 16.

TR = total return for the index, which includes any dividends as well as any other cash distributions during the period. Treasury note yield is expressed in basis points.

Buffett on Retirement, Investing

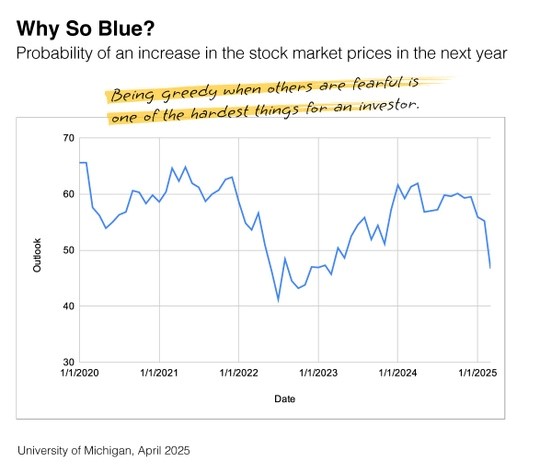

“Be fearful when others are greedy and greedy when others are fearful,” are the words of wisdom from Warren Buffett.

There’s just one small catch—it may be the most difficult thing for an investor to do.

Over six decades, Warren has learned to look past gloomy headlines and focus on a brighter tomorrow. He wants all investors to consider the stock market’s long-term history and not let emotions guide their short-term thinking.

But it’s so difficult.

Warren Buffett, 94, said in early May he will ask the board of directors to have Greg Abel replace him as CEO at the end of 2025. Buffett, who plans to stay on as Chairman of the Board, told shareholders he might “hang around” to help.

Today’s chart shows that only 46 percent of investors see stock prices higher in the next 12 months.

And who can blame them? There are so many things to worry about these days, which leads me to another one of my favorite Wall Street quotes: “Stocks climb a wall of worry.” This quote suggests that investors should maintain their discipline even when there are a ton of reasons to believe the market will fall.

No one can tell you where stock prices will be in a year, two years or five years.

But remember, there’s no shortage of quotes about keeping your cool during periods of volatility from seasoned Wall Street pros, including, “I would tell [investors], don’t watch the market closely.” That’s also from Warren. He said it in 2016. (In case you were wondering, he said the “be greedy, be fearful” quote in 2008.)

So different year, same message. Don’t watch too closely.

Source: CNBC.com, May 3, 2025