When Will the Fed Start Cutting Interest Rates?

The Fed’s Drive to 2% Inflation

Wall Street keeps asking, “When will the Fed start cutting interest rates?” But perhaps the better question is, “What is the Fed looking for before it would consider cutting interest rates?”

As you may recall, the Fed indicated in December that as many as three rate cuts were possible this year. However, Fed Chair Powell said in February that the Fed was in no hurry to change its interest rate policy. Powell did indicate:

The Fed is not looking for better data, but they are looking for more good data already pointing to continued cooling inflation.

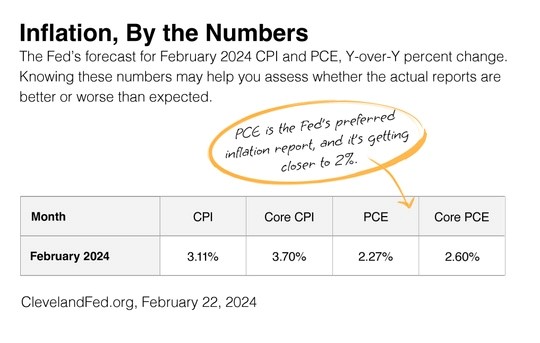

Remember that January’s inflation report was a bit hotter than expected, which complicated the Fed’s interest rate decision. It also puts a spotlight on February’s Consumer Price Index (CPI) update, scheduled for release on March 12, and the Personal Consumption Expenditures Price Index (the inflation index that is favored by the Fed) on March 29. Will they support the Fed’s “more good data” narrative?

The Fed’s next scheduled two-day meeting concludes on March 20. After that, it has six more scheduled meetings for the year. Remember, the Fed can hold unscheduled meetings as needed. The last time the Fed held unscheduled meetings was in March 2020 in response to the pandemic.

The CMEGroup’s FedWatch Tool shows almost no market watchers are anticipating a Fed rate cut at the March meeting and the support for a cut at the May meeting is fading. Speculators are mixed about a cut in June and July as, despite the election looming, the Fed takes its independence very seriously. It’s unlikely that the Fed will consider the election cycle in their determination as to if and when interest rates are lowered.

Will the Fed cut rates in 2024? The trend appears to be moving in that direction, but it’s uncertain when the Fed will be comfortable.

Market Insights

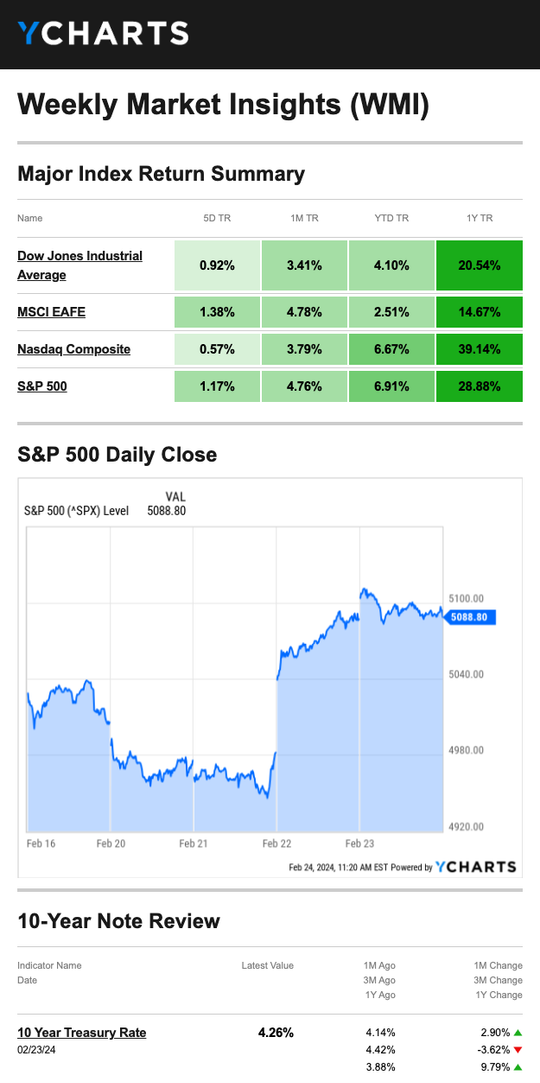

Stocks vaulted to new heights last week on the back of an artificial intelligence (AI) semiconductor company, marking investors’ belief that AI has the potential to transform the U.S. economy.

Stocks traded in a fairly tight range for the first half of the short week, yawning at the lack of economic data while awaiting earnings results from one key company that creates chips that power the artificial intelligence operations of many firms.

A strong Q4 corporate report and long-term message from Nvidia Corp. pushed the S&P 500 and Nasdaq to new closing highs. Nvidia’s market cap rose by $277 billion on the news, pushing it to a $2 trillion valuation. To put that in perspective, Nvidia’s market cap is now roughly the same size as Canada’s economy. Its 16% gain was the largest one-day market cap increase by any U.S. company.

Remember, companies mentioned are for illustrative purposes only. It should not be considered a solicitation for the purchase or sale of any company connected with AI.

Source: YCharts.com, Feb. 24, 2024.

What Happened to the Recession?

For nearly two years, signs have pointed to a recession, and yet, the economy continues to hum along. In fact, one multinational bank officially announced that it no longer expects the U.S. economy to move into a recession this year.

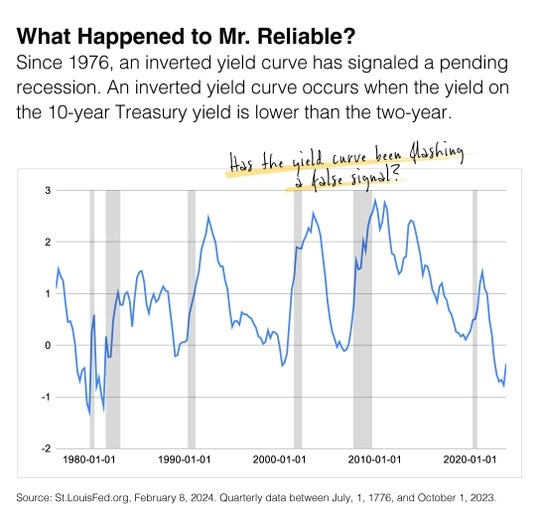

In the accompanying chart, we can see that when long-term Treasury yields fall below shorter-term returns, an inverted yield curve is created. This phenomenon has signaled every recession since 1976. Except this time, it’s different. There’s no recession in sight despite an inverted yield curve that began in July 2022.

The question is, why?

“Don’t worry about the horse; load the wagon.”

In other words, don’t let things you can’t change have an impact on the things you can. That’s just one of the many reasons we craft your portfolio strategy to anticipate market volatility while also accounting for your goals, time horizon and risk tolerance. As always, if you have any questions about the above, please don’t hesitate to ask. Otherwise, we’ll continue to monitor markets and the economy with your goals firmly in mind.