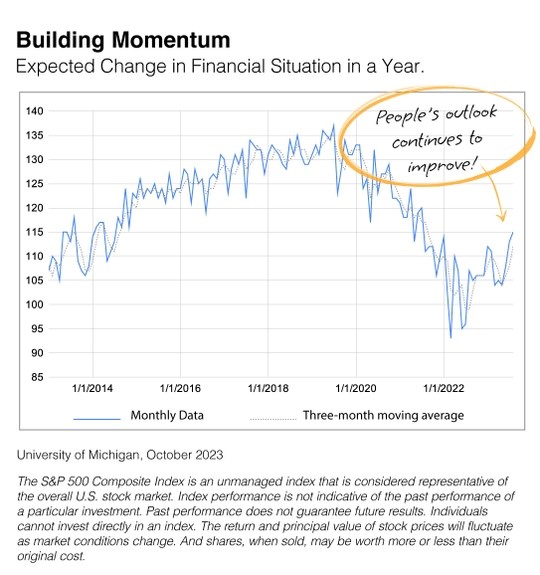

Consumers Expect Better Days Ahead

Many consider the University of Michigan the gold standard for reporting on consumer sentiment and trends. Among its 50 monthly reports, the most well-known is the “UMich Consumer Sentiment” survey, which measures consumer confidence. As we see below, the index has been trending higher for over a year as inflation has moved lower and financial markets gained.

Investors believe their financial situation will improve due to a wide range of factors, including interest rates and home prices, to name a few. When investors are positive about the future, they tend to be more comfortable making longer-term commitments. So when you see negative updates on credit card debt, the jobs market or other reports, remember what this chart tells us: Despite all the concerns, people believe their financial situation will improve.

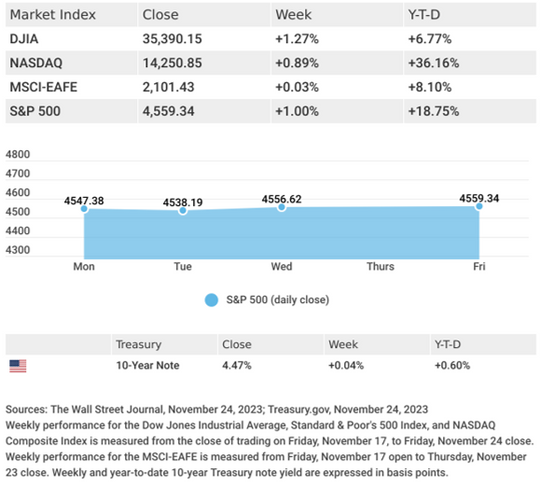

Market Insights

Investor enthusiasm for stocks remained strong last week, buoyed by declining bond yields in a holiday-abbreviated trading week. The Dow Jones Industrial Average picked up 1.27%, while the Standard & Poor’s 500 gained 1.00%. The Nasdaq Composite index rose 0.89% for the week. The MSCI EAFE index, which tracks developed overseas stock markets, was flat (+0.03%).

Falling Yields Lift Stocks

The stock market continued to look toward the bond market for direction, responding positively to bond yields that fell steadily for much of the week. A successful 20-year Treasury notes auction on Monday triggered a decline in bond yields. The release of the minutes from the Fed’s last meeting buoyed investor optimism that the potential for further rate hikes was diminishing.

Investor sentiment was also lifted by the earnings results from a leading mega-cap, AI-enable chipmaker that topped analysts’ expectations, bolstering the narrative of AI’s potential to help corporate profits. Despite a higher turn in bond yields on the final half-day of trading, stocks retained the week’s gains.

Fed Minutes

Minutes from the Oct. 31–Nov. 1 meeting of the Federal Open Market Committee were released last week, providing insight into its decision not to raise rates and its thinking on the future direction of interest rates.

The minutes reflected concerns by committee members that inflation remained stubborn and may move higher. The minutes also reaffirmed the messaging of many Fed officials, including Fed Chair Powell, that monetary policy must remain restrictive until they are convinced inflation will be on track for the Fed’s two percent target. They further said that future rate decisions will be based on fresh economic data, offering no indication that a rate cut was forthcoming, as many analysts are increasingly anticipating for 2024.