Stocks Bounce Back

2024 Outlook: Fed Stays the Course

When you see hypothetical examples of stock market performance, the illustrations often use average annual returns of between 8% and 10%. But how often does the stock market return between 8% and 10%?

Only four times in the past 76 years.

Through March 22, the Standard & Poor’s 500 index had gained 10% year-to-date. So does that mean you should expect an “average” year?

At its March meeting, Fed Chair Powell said the Fed still anticipates cutting short-term rates three times this year. That move boosted investor confidence in the short term and may help boost longer-term confidence, too.

For example, lower interest rates can help the overall economy as the trend often emboldens CEOs to make long-term capital investments, which helps set the groundwork for future growth.

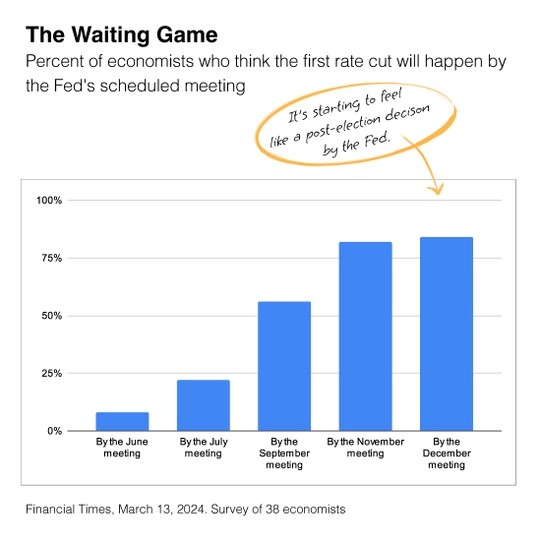

When will the Fed make its first move? As you can see from the table, more economists are starting to believe it’s a late 2024 decision. But remember, the stock market is a discounting tool, meaning it’s looking six to nine months into the future. So, today’s S&P 500 is seeing business conditions in the October-to-December timeframe.

Stock prices are off to a solid start in 2024. But that shouldn’t have you rethinking your strategy. Remember, you created your investment approach based on your goals, time horizon and risk tolerance. Unless one of those has changed, stay the course.

Market Insights

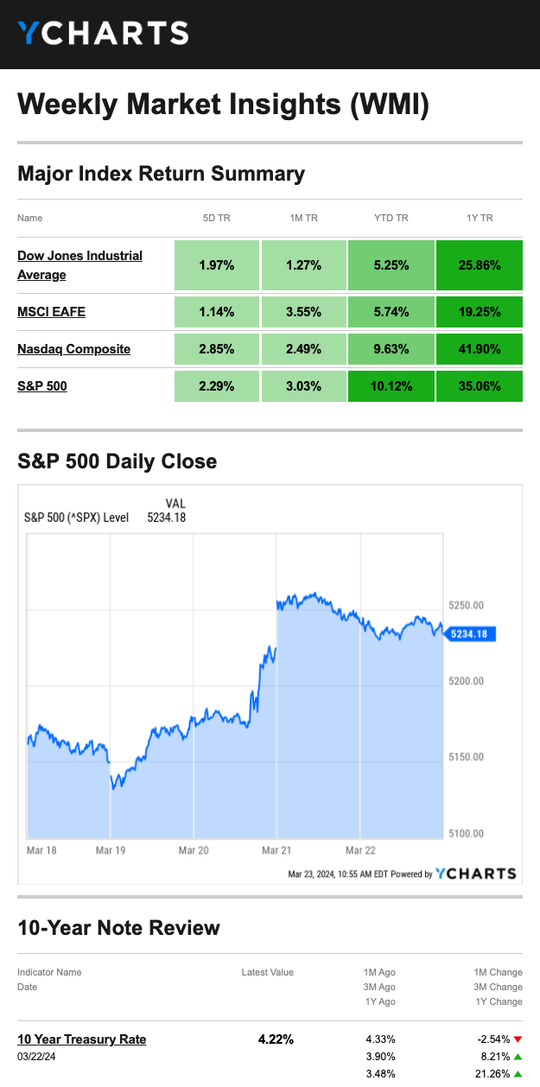

Stocks posted their best week of the year, sparked by news that the dovish Fed decided to keep rates steady and signaled three rate cuts were still possible this year.

As widely expected, the Fed left rates unchanged at the conclusion of its two-day meeting. But somewhat less expected, the Fed signaled its inclination to cut interest rates three times this year—each time by a quarter percentage point. That was a positive surprise for some, who worried that recent hot inflation reports would cause the Fed to reconsider its stance.

Markets pushed higher Wednesday following the news, with all three averages closing at record highs. The rally continued through Thursday, boosted further by news that existing home sales rose 9.5 percent in February.

The week’s rally was broad-based overall, with 10 of the 11 S&P 500 sectors posting gains (health care dropped slightly). At one point late in the week, nearly one in four S&P 500 stocks were trading at 52-week highs. That was the highest proportion in three years, which supports the idea that the rally was broadening out from mega-cap tech stocks.

Source: YCharts.com, March 23, 2024

It’s Feeling like a Goldilocks Moment

Economists describe a Goldilocks economy as one that’s not too hot and not too cold; it’s just right. And 2024 is starting to feel just right.

When the Fed started to raise short-term interest rates in early 2022 to rein in inflation, Chairman Powell’s top priority was to manage consumer prices by slowing economic growth without pushing the U.S. into a recession. The goal was to have a soft landing, or what’s called a Goldilocks moment.

So far, the 2024 economic scorecard looks like Goldilocks 1, Recession 0.

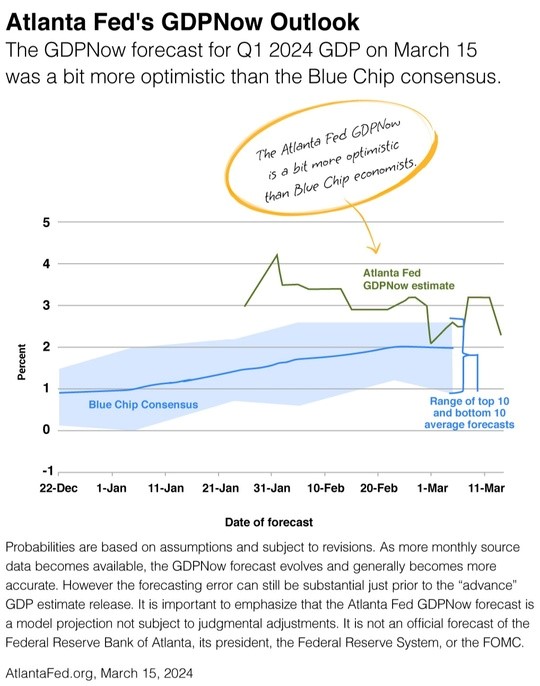

Consumer inflation is slowing, but it’s still above the Fed’s target of 2%. Gross domestic product is solid, with the Atlanta Fed’s GDPNow showing Q1 growth forecast of 2.1%. And payrolls increased by 275,000 jobs in February, which means companies are hiring. Taken together, all three suggest no recession in sight at this point.

Meanwhile, the Standard & Poor’s 500 stock index continued to improve in March. Keep in mind the stock market is a discounting mechanism, meaning it’s anticipating what the economy will look like in 6-9 months, which has some wondering if Goldilocks may kick off her shoes and stay a while. Remember that past performance is no guarantee of future results.

Source: CNBC.com, March 12, 2024. “Consumer prices rose 0.4% in February, and 3.2% from a year ago.”

The opinions contained herein are that of the authors and not necessarily that of Private Client Services LLC and should not be construed as tax or legal advice nor should there be any guarantees assumed from the information presented.