Will Middle East Tensions Push Rates Higher?

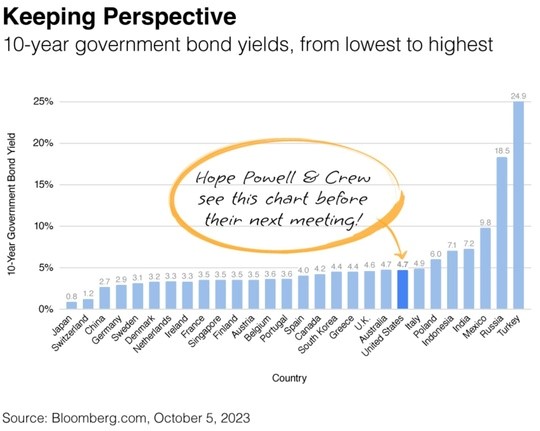

The Fed’s ongoing pledge of “higher interest rates for longer” has rattled financial markets and raised the cost of everything from mortgages to credit cards. Now adding to tensions are the recent events in the occupied territories of Israel and Palestine which, in addition to a grievous loss of life, immediately pushed oil prices higher. Higher oil prices could translate to inflation, which may give the Fed another reason to keep rates higher for longer. But are rates high enough? In the accompanying chart, you can see that the current rates on the 10-year government bond are higher than most of Europe, where inflation is higher than the U.S.

Remember, the Fed is trying to “thread a needle” by raising interest rates to slow the economy–and reduce inflation–without causing a recession. So, while you may be starting to experience some relief from inflation at the grocery store, if you are shopping for a new car, expect to find the cost of financing is higher. Those higher rates may prompt some to hit “pause” on that new car, which is exactly what the Fed wants. The Fed may have a few more things to consider at its upcoming meeting ending on Nov. 1, 2023.

Market Insights

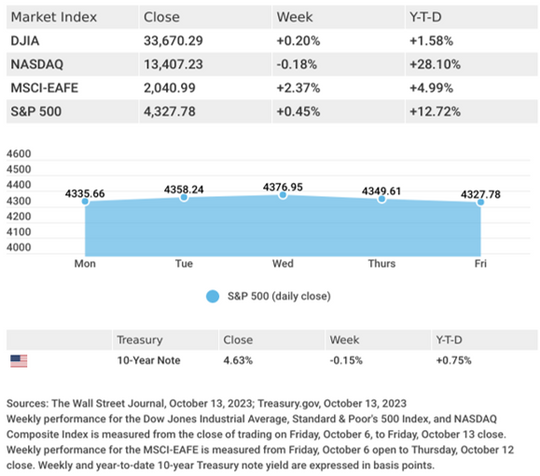

Stocks ended mixed last week amid the outbreak of hostilities in the Middle East and higher-than-expected inflation data. The Dow Jones Industrial Average gained 0.20%, while the Standard & Poor’s 500 rose 0.45%. But the Nasdaq Composite index slipped 0.18% for the five trading days. The MSCI EAFE index, which tracks developed overseas stock markets, advanced 2.37%.

Inflation Hurts Sentiment

Stocks exhibited remarkable resilience in the face of a surprise attack on Israel and hotter inflation data than investors expected. Stock prices initially buckled on the breakout of hostilities in the Middle East. Still, they rallied in afternoon trading as investors gained optimism that the war may not spread to other countries. Oil and defense stocks rose sharply, while airlines fell. Stocks continued to advance into Wednesday as falling bond yields and a retreat in oil prices overcame the disappointment of an elevated wholesale inflation report. When consumer prices also came in higher than anticipated by Wall Street, stocks moved lower in response to higher bond yields. The weakness continued into Friday on a bump in consumer inflation expectations despite a solid start to a new earnings season.

PPI, CPI Updates

The disinflationary trend appears to be stalling if the inflation numbers are any indication. September’s producer price index (PPI) came in higher than expected, rising 0.5% versus a forecast of a 0.3% increase, while the year-over-year increase of 2.2% was the most significant jump since April. The driver of last month’s hop was in goods, which surged 0.9%. Consumer inflation data followed, which also came in hotter than forecast. The Consumer Price Index (CPI) rose 0.4% in September and 3.7% year-over-year above the forecast of 0.3% and 3.6%, respectively. The news on core inflation was a bit more comforting, rising in line with expectations.

Source: CNBC, October 12, 2023