Economic Update: Market Insights

Is the Bear Market Over?

That’s a popular question. And our answer – “let’s give it a little time.” But people are quick to say that stocks are off to a good start in 2023, inflation appears to be trending lower and the economy was strong in Q4. All true. But it takes more than a few good weeks and a couple of solid economic reports to inspire a new market cycle.

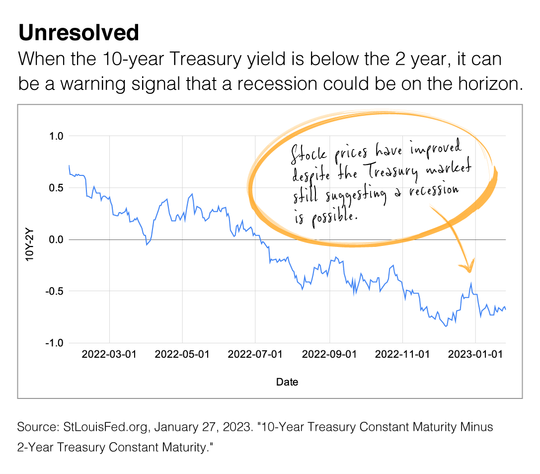

Right now, there are several questions that the financial markets need to address in the coming months. For example, will the economy enter a prolonged slowdown? The accompanying chart shows the US Treasury market is still signaling a recession.

What we can tell you is that between 1942 and 2021, the average Bull market lasted 52.8 months, while the average Bear market lasted 11.3 months. The Bear market of 2020 ended in a little over one month, but the back-to-back bear markets of the early 2000s spanned a painful 2½ years.

The current Standard & Poor’s 500 bear market was called on June 13, 2022, when stock prices dropped 20% from their high. Some people point out that stock prices started trending lower in January 2022, but that wasn’t the beginning of the bear market.

As we get deeper into 2023, Adams Brown wealth consultants will continue to review economic data and company reports to get a better understanding of what trends are emerging.

Market Insight

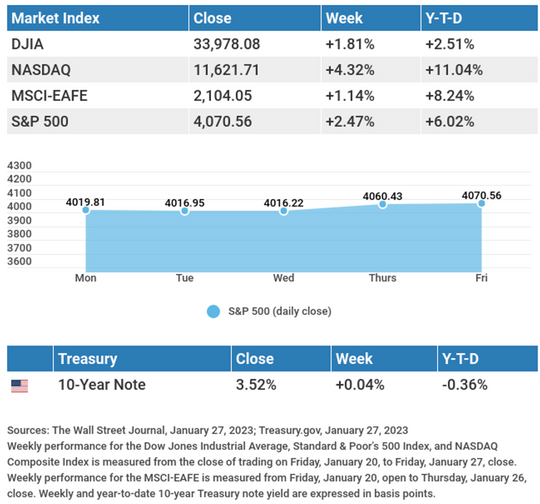

Stocks added to their early 2023 gains amid a busy stream of mixed corporate earnings results and conflicting economic data. The Dow Jones Industrial Average gained 1.81%, while the Standard & Poor’s 500 added 2.47%. The Nasdaq Composite index rose 4.32% for the week. The MSCI EAFE index, which tracks developed overseas stock markets, increased by 1.14%.

Stocks Advance

With the backdrop of earnings reports and conflicting economic data, stocks climbed higher on cooling inflation, continued economic resilience, and fourth-quarter corporate earnings results that, while underwhelming, did not appear as bad as many had feared.

There was enough new economic data to support both the “recession is coming” and the “soft landing” camps. It was corporate results and continued labor market strength, along with a solid, if weakening, fourth-quarter Gross Domestic Product (GDP) growth number, however, that raised investors’ hopes that a potential recession may be mild and likely pushed out to later in the year.

GDP Report

The U.S. economy expanded at a 2.9% annualized rate in the fourth quarter, slightly exceeding consensus estimates of 2.8% but down from the third quarter’s 3.2% growth rate. Consumer spending, which accounts for over two-thirds of GDP, rose 2.1%. Increases in private inventory investment, government spending, and nonresidential fixed investment also contributed to the fourth quarter’s growth. Weakness in housing and a drop in exports subtracted from the quarter’s result.

Beneath the headline number, the personal consumption expenditures price index (the Fed’s preferred measure of inflation) rose 3.2%. That was lower than the third quarter’s 4.8% increase, though it remains above the Fed’s 2% inflation target rate.

Identity Theft Awareness

It’s Identity Theft Awareness Week. Anytime is a good time to tighten up your identity security, but if you haven’t been as careful as you intended, consider this your annual reminder. Here are a few best practices to adopt or continue:

- Change your passwords regularly: Every few months is a great habit to get into. If you change yours today, remind yourself to change them again in six months.

- Check your credit report: You may have been the target of identity theft or fraud and not even realize it until it shows up on your credit reports.

- Tax time is prime time for identity thieves: They would love to get their hands on your 1040 form, and they would also love to claim a phony refund using your personal information. Be careful when sharing information online (see below).

- The IRS doesn’t use unsolicited emails to request information from taxpayers: If you get an email claiming to be from the IRS asking for your personal or financial information, report it to your email provider as spam.

- Avoid “coffee housing” your personal information: Never risk disclosing financial information over a public Wi-Fi network. (Broadband is susceptible, too.) It takes little sophistication to do this—just a little freeware.

- Look for the “https” & the padlock icon when you visit a website: Not just http, but https. When you see that added “s” at the start of the website address, you are looking at a website with active SSL encryption, and you want that. A padlock icon in the address bar confirms an active SSL connection. For solid security when you browse, you could opt for a VPN (virtual private network) service that encrypts 100% of your browsing traffic. Being careful with your personal data means more than just shredding your documents. Share these reminders with friends and family and help protect against identity theft.

Food for Thought

“Fact creates norms, and truth illumination.”

– Werner Herzog