Outlook 2023: Economic Update

Interest Rates, COLA Increase & Recordkeeping

What does the bond market know that the Fed isn’t telling us?

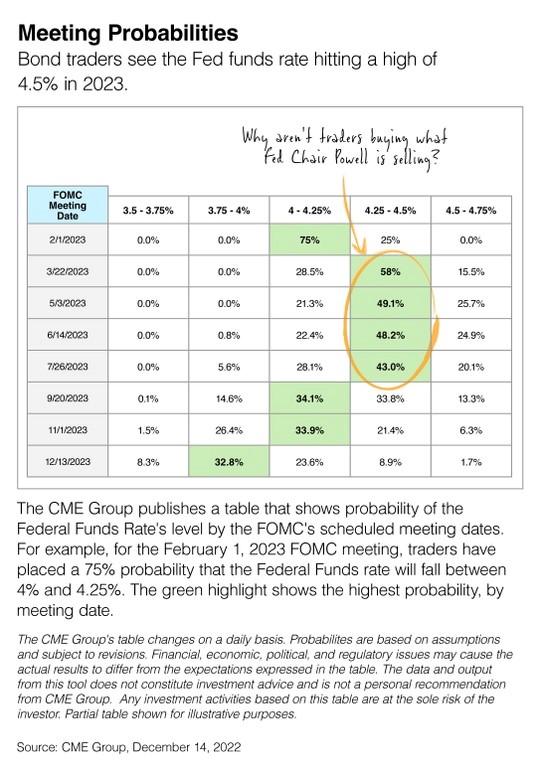

Fed officials recently have said that short-term rates will need to climb to over 5 percent to bring inflation under control. But in the table below, you can see that the bond traders say short-term rates will top out at 4.5 percent in 2023 and then head lower.

The bond market is more dovish than the Fed. And perhaps with good reason. The November Consumer Price Index report came in below expectations, and there are more and more signs that inflation has started to trend lower, which may suggest the Fed’s work is coming to an end.

So why is the Fed talking so tough? As many of you may recall, Fed Chair Jerome Powell said inflation was “transitory” throughout much of 2021. The Fed Chair doesn’t want to mischaracterize inflation again.

CEOs Are Cautious

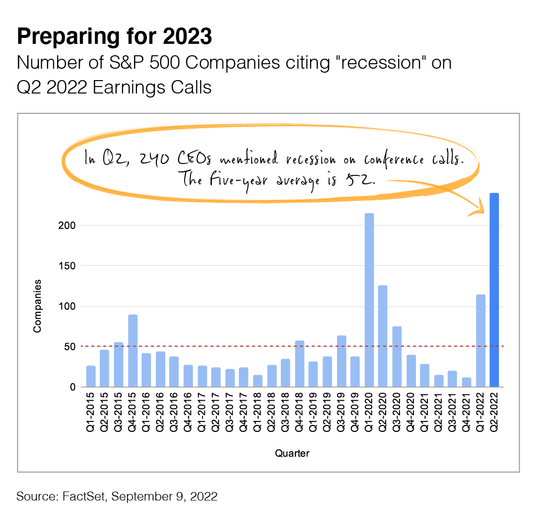

It appears that America’s corporate leaders are preparing for the worst while hoping for the best. Almost half of S&P 500 CEOs in second-quarter conference calls pointed to “recession” as a potential headwind in 2023. In response, some companies have chosen to trim headcount while others are managing budgets and looking for operational efficiencies.

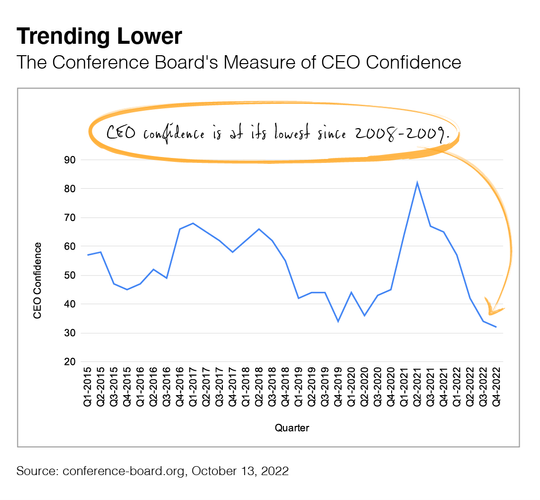

Across the board, however, the focus on a potential recession is taking a toll on CEO confidence. The Conference Board’s Measure of CEO confidence is at its lowest since 2008.

Remember, it’s healthy for companies to prepare for a challenging economic climate, and CEO confidence may grow once we see more green shoots in the economy. After all, by this time next year, the buzzword of the quarter could be something else entirely, like “recovery,” “rebound” or “growth.” That type of language can only help boost confidence.

Social Security 2023 COLA Increase Kicks In

While you probably already found your notice in the mail, you may be curious about the COLA increase happening for Social Security recipients in the New Year. Starting in January, beneficiaries will see an 8.7% increase to help offset inflation and its effects on day-to-day costs.

This means a $146 increase in the monthly benefit for most retirees. Meanwhile, Medicare Part B premiums will shrink back about 3% to $164.90, down $5.20 from last year; since these premiums are typically taken from Social Security benefits, that also bumps up the monthly payout.

While many retirees rely on Social Security for a significant portion of their retirement income, it’s important to remember those who collect payments while still earning income from work or some other source. Those still earning such income may want to consider adjusting their tax withholding.

Keep Well-organized Records Until Period of Limitations Expire

Well-organized recordkeeping makes it easier to prepare your tax return and provide evidence of tax deductions. According to the IRS, you must keep records, such as receipts, canceled checks and other documents that support an item of income, a deduction or a credit appearing on a return as long as they may become material in the administration of any provision of the Internal Revenue Code. Depending on the assessment, these periods of limitation can range from three years to no limit.

There are also periods of limitations for refund claims, which range from two to seven years. The IRS recommends keeping records of property records, healthcare insurance and business income and expenses, among other categories.

*This information is not intended to be a substitute for specific individualized tax advice. We suggest that you discuss your specific tax issues with a qualified tax professional. Source: IRS.gov, August 8, 2022