Stable Stocks Amidst Economic Uncertainty

CEOs Talk Inflation

Over the next several weeks, we will hear from corporate leaders as they update investors on their first-quarter financials and provide a glimpse into the rest of the year. But this quarter, the actual financial results may be of only secondary importance. Investors will be more interested to hear what corporate leaders say about the future, especially in light of a more uncertain economic outlook.

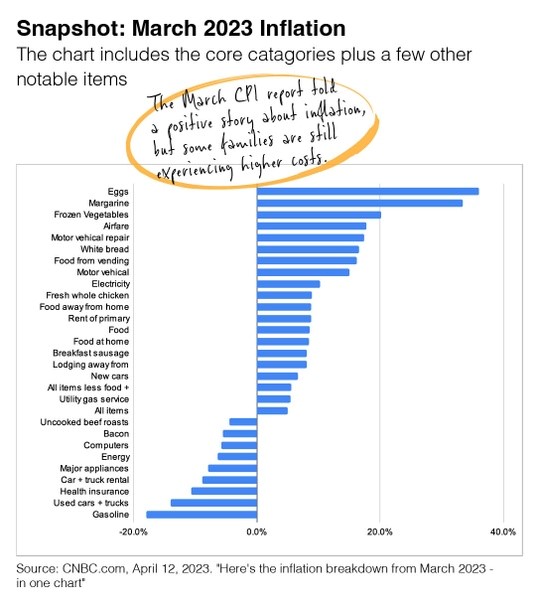

One hot topic will be inflation. Investors will want to know whether inflation increases overall costs and whether companies may pass those costs to customers through price increases.

In the accompanying chart, you can see where households across the country are experiencing inflation. While some prices are trending lower, others remain stubbornly high.

Market Insight

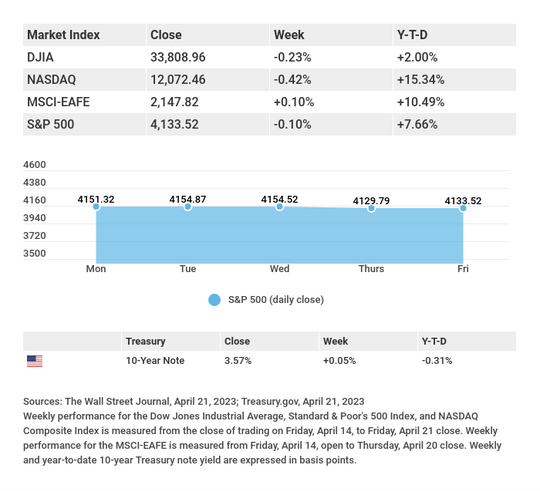

Stocks remained resilient last week amid mixed earnings reports, hawkish Fed-speak, and lingering recession fears, closing out the five trading days with small losses.

The Dow Jones Industrial Average slipped 0.23%, while the Standard & Poor’s 500 lost 0.10%. The Nasdaq Composite index fell 0.42% for the week. The MSCI EAFE index, which tracks developed overseas stock markets, added 0.10%.

Stocks Hold Firm

Stocks traded most of last week around the flatline as investors grappled with several headwinds.

The first was disappointing earnings results, coupled with the absence of earnings guidance from some companies due to an uncertain economic climate. Weak economic data, including declines in housing and leading economic indicators, also weighed on investor sentiment. Finally, multiple Fed officials spoke last week, signaling that inflation remained too high and that further rate hikes may be likely.

Underneath the seemingly placid surface of the major market indices, there was substantial price action at the individual stock and sector level. Poor earnings results hit communication services stocks and regional banks, while margin pressures put pressure on auto stock valuations.

Housing Weakness

Two housing reports reflected ongoing fragility in the housing market and fed prevailing economic slowdown worries.

Sales of new homes fell 0.8% in March, dragged down by a 5.2% slide in new multi-family home construction. Sales of single-family homes were a bright spot, rising 2.7% to a three-month high, though that hopeful note was tempered by an 8.8% drop in new application permits–an indicator of future new home building.

Existing home sales also suffered a month-over-month decline in March, falling 2.4%. Sales plummeted 22% from March 2022 levels as higher mortgage rates and tight inventories impacted affordability.

Tax Benefit & Credits: FAQs for Retirees

Lots of questions can come up about income taxes after retirement. Listed are answers to just a few common questions from retired taxpayers.

What types of income are taxable?

Some common types of taxable income include military retirement pay, all or part of pensions and some retirement accounts, unemployment compensation, gambling income, bonuses and awards for work, and alimony or prizes.

What types of income are non-taxable?

A few examples of non-taxable income are veteran’s benefits and disability pay for specific military or government-related incidents, worker’s compensation, and cash rebates from a dealer or manufacturer of an item you purchased.

Why is my pension taxed?

It might depend on how the money was put into the pension. For example, if the money was not taxed before going into the plan, it may be taxable. Conversely, if your contribution is from already-taxed dollars, that portion of the pension may not be taxed.

Contact an Adams Brown advisor to discuss your wealth management goals.